Comments

HOUSING - As California grapples with an ongoing housing crisis, renters in Greater Los Angeles face a new challenge — finding a home in an increasingly competitive market, beyond costs. According to our latest Rental Market Competitiveness Report, soaring lease renewals and slower construction have left fewer units available, driving up competition and making it harder for renters to find new housing options.

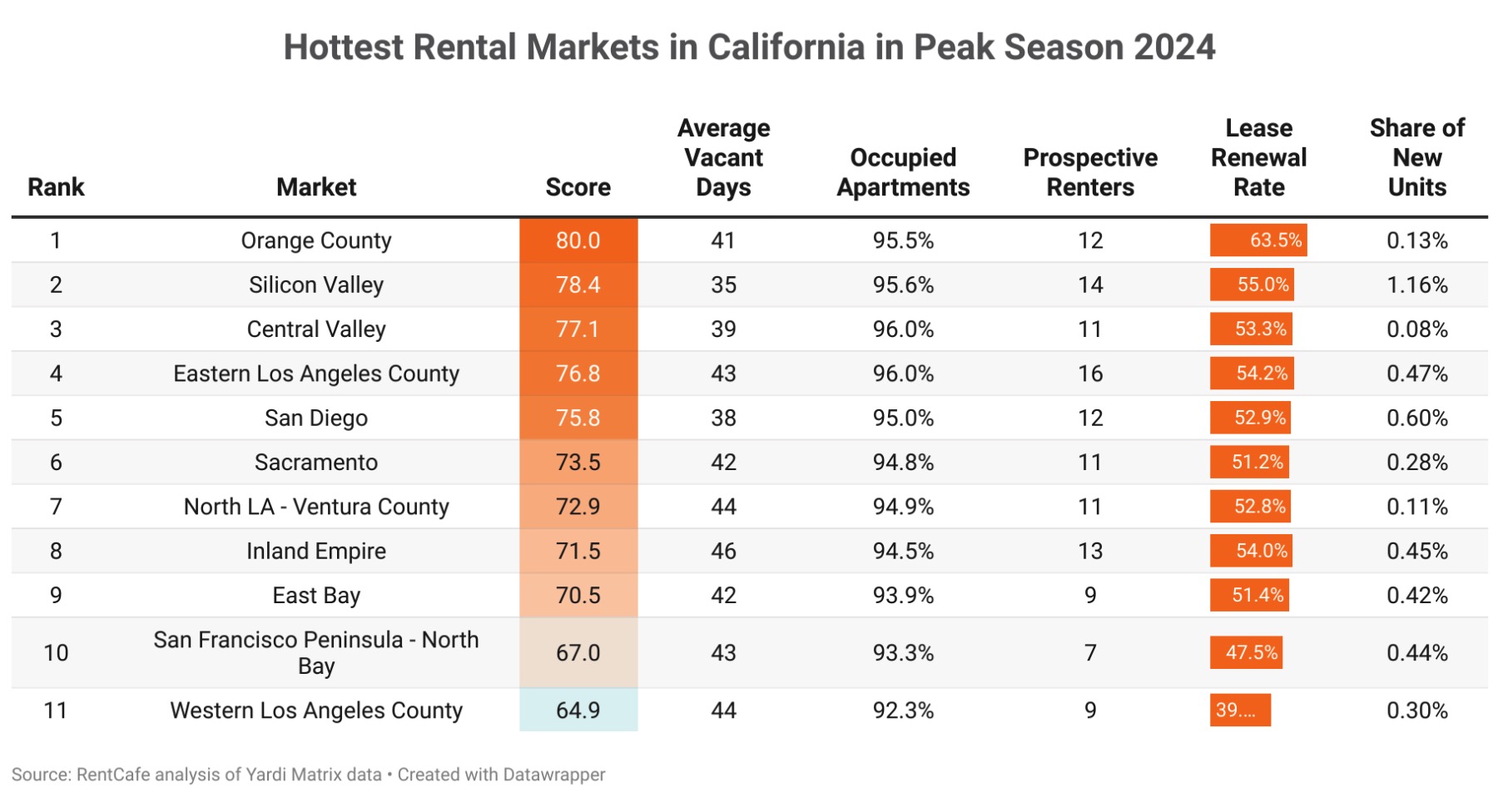

Orange County is now California’s hottest rental market, while Eastern Los Angeles County ties for the state's highest occupancy rate at 96.0%, with 16 prospective renters competing for each available unit. In contrast, Western Los Angeles County has the lowest competitiveness score (64.9) and occupancy rate (92.3%). Meanwhile, North LA is seeing rising competitiveness due to limited new construction.

Here’s what we found:

- Orange County is now California’s most challenging rental market. The competitiveness score surged to 80.0 (up from 70.5 last year), with a 95.5% occupancy rate and 12 renters competing per apartment. Limited new apartments entering the market—just 0.13% (down from last year’s 0.66%*)—combined with the highest lease renewal rate in the region at 63.5% (up from 61.0%), means even fewer options for prospective tenants.

Main cities: Irvine, Anaheim, Santa Ana, Fullerton, Costa Mesa, Huntington Beach, Tustin, Newport Beach, Orange, Garden Grove, Aliso Viejo, Buena Park and Laguna Niguel

- Eastern Los Angeles County holds the highest occupancy rate at 96.0%, with 16 renters competing per apartment (down from 20 in 2023). The competitiveness score rose to 76.8 (up from 68.9 last year). The lease renewal rate jumped to 54.2%, up significantly from last year’s 43.3%, while 0.47% of new apartments entered the market, a slight increase from 0.34%.

Main cities: Long Beach, Eastern Los Angeles City, Pasadena, West Covina, Pomona, Rowland Heights, El Monte and Downey

- In North LA, fewer new apartments—just 0.11% (down from 0.45% last year)—have driven a sharp rise in competition. The competitiveness score climbed to 72.9 (up from 66.9), with an occupancy rate of 94.9% and 11 renters per unit. Also, the share of renters staying put increased to 52.8% (up from 49.9%).

Main cities: Woodland Hills, Van Nuys, North Hollywood, Oxnard, Santa Clarita, Lancaster, Northridge, Canoga Park and Burbank

- Inland Empire renters face more pressure, with 13 renters per unit (up from 12 last year) and a competitiveness score of 71.5 (up from 65.9). While 0.45% of new apartments entered the market—a significant jump from last year’s 0.09%—demand still outpaces supply.

Main cities: Riverside, Rancho Cucamonga, San Bernardino, Ontario, Moreno Valley, Corona, Fontana, Upland, Temecula and Indio

- Western Los Angeles County saw less pressure compared to other areas, but the competitiveness score rose to 64.9 (up from 58.0). Occupancy rates dipped slightly to 92.3% (down from 93.7%), and fewer new apartments entered the market, accounting for 0.30% of the stock (down from last year’s 1.08%).

Main cities: Western Los Angeles City, Marina Del Rey, Torrance, Santa Monica, Hawthorne, Hollywood, Culver City and Inglewood

*The influx of new apartments at the beginning of peak rental season 2024 compared to the influx at the beginning of peak rental season 2023

Why it matters for renters: With fewer new apartments and higher lease renewals across Greater Los Angeles, competition for available units is fiercer than ever. This trend could lead to longer searches for tenants, and limited options for those hoping to relocate within the area.

###