CommentsPERSPECTIVE-The Government Accounting Standards Board (GASB) is pretty clear about how it wants state or local governments to report Net Pension Liability. As stipulated by its Statement 68, on the face of the financial statements, not buried in the morass of footnotes.

But the City of Los Angeles did not read the memo.

A quick survey of the Comprehensive Annual Financial Reports (CAFR) of a few major cities – New York, Seattle and San Francisco – show compliance.

There are probably a few, besides Los Angeles, who have failed to do so, but weak oversight by GASB is a prescription for sloppiness.

There is no shortage of other professional or authoritative materials on the subject, for example, articles published by the AICPA, such as this government brief.

This is also the second year in a row where the liability was not reported on the face of the financial statements…and the pronouncement has only been in effect for two years! Although the required footnote disclosures were included, footnotes amplify the contents of the standard accounting reports; they are not a substitute.

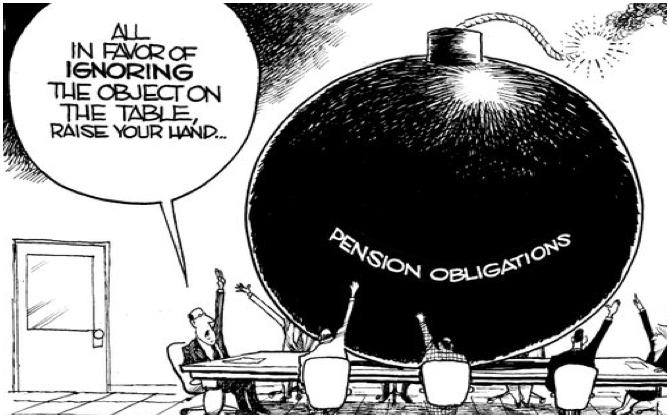

Before I go any further, why is this even important?

Analysts, accountants and numbers geeks will know to dive into the footnotes, so who cares if it is not staring at the users on the face of the balance sheet, or statement of net position, as it is also called?

As GASB and others have clearly stated, it is about transparency.

As residents, we are the most important recipients of the city’s financial statements. We live here and bear the consequences of our elected officials’ decision-making; the financial effects of which are imparted in the CAFR. Even though only a fraction of the residents bother cracking open the CAFR, and those that do rarely get into the footnotes, there is an obligation to provide complete disclosure. Anything less is implicitly misleading and a disservice.

I would not be as irritated or concerned if this had not occurred before, but suspect political pressure is behind not reporting the NPL as evidently as it should. And that rankles me more…as it should you!

Most of our officials depend on the support of the public unions to fund their campaigns. In return, they receive generous retirement benefits that come at a high cost to the residents of the city.

Shining the light on the $7 billion net liability that has been incurred to support these plans is not in their best interests. It’s much safer to bury it in a line with other long-term liabilities. Doing so does not invite questions.

The NPL is over 50% of the total long-term liability in the governmental activities segment. It cries out for the specific recognition GASB 68 mandates.

To make matters worse, the footnotes downplay its significance by stating it is not, by itself, evidence of economic or financial difficulties.

Tell that to the city of Richmond, CA, which faces the prospects of bankruptcy. Its residents are already feeling the impact of diminished services, the result of diverting more of the budget to pay for pensions. Add San Bernardino, Stockton and Vallejo to the list, too. Others will follow.

In Los Angeles, we cannot afford to increase the police budget to deal with the rising crime rate.

So while our officials avoid the subject, we will pay more for less service. That’s the city’s plan to deal with the problem.

The City Controller is in a position to educate the public about the dangers of ignoring this bleak prospect. Ron Galperin has the wherewithal and the standing to heighten awareness, but if he is not willing to at least give it the basic recognition it warrants on the face of the balance sheet, where it is more visible, then it is unlikely to get any attention at City Hall.

Galperin has not shied away from auditing waste and abuse, however unpopular that has been among some powerful forces. He is still the most effective City Controller we’ve had, but he must lead the charge to fight the pension cancer, which is consuming our city from the inside.

The NPL is the tip of an iceberg. Pretending it is not there will only run the city into the rest of it.

(Paul Hatfield is a CPA and serves as President of the Valley Village Homeowners Association. He blogs at Village to Village and contributes to CityWatch. The views presented are those of Mr. Hatfield and his alone and do not represent the opinions of Valley Village Homeowners Association or CityWatch. He can be reached at: [email protected].) Prepped for CityWatch by Linda Abrams.

Explore

Our mission is to promote and facilitate civic engagement and neighborhood empowerment, and to hold area government and its politicians accountable.

CityWatch Los Angeles

Politics. Perspective. Participation.

CityWatch Los Angeles

Politics. Perspective. Participation.

18

Fri, Apr