CommentsLA WATCHDOG--According to the opaque actuarial report for the Los Angeles City Employees’ Retirement System (“LACERS”), 2016 was a good year. The return on its investment portfolio was 7%, the unfunded pension liability of $5.5 billion was $200 million lower than the previous year, the funded ratio “improved” to 72.6% from 70.7%, and the City’s 2017-18 Annual Required Contribution (“ARC”) to LACERS may be lower than this year’s payment.

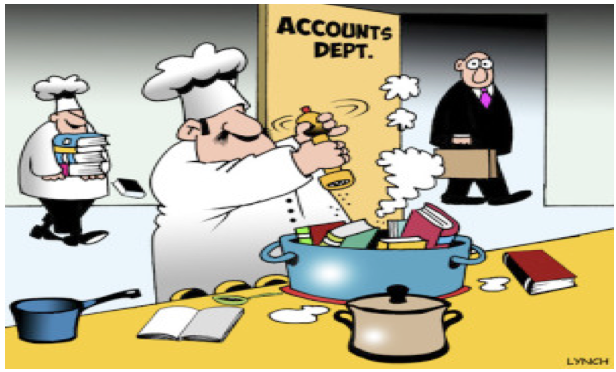

But a more realistic analysis reveals that the City is “cooking the books,” relying on a set of false assumptions and policies that cover up the severity of the pension crisis.

In the real world, the return on investment was breakeven, the unfunded pension liability increased to almost $9 billion, the funded ratio decreased to a unhealthy 61%, and the ARC is understated by at least $300 million.

There are two policies adopted by the City that allows it to pull the wool over our eyes: “smoothing” where gains and losses compared to the targeted rate of return of 7.5% are amortized over a seven year period and two, the reliance on an overly optimistic investment rate assumption of 7.5%.

Smoothing was designed to even out the City’s pension contributions so they would not bounce around in an unpredictable manner based on the ups and downs of the stock market. But this has resulted in an understatement of the unfunded pension liability of $750 million as the cooked up actuarial value of its assets exceeds their market value by the same $750 million.

Smoothing also resulted in LACERS showing a 7% return on its investments. But in the real world, the ROI was breakeven (+0.05%) for the year, which, when compared to the targeted rate of return of 7.5%, resulted in an increase in the unfunded liability of almost $800 million, not a $200 million decrease as advertised by the actuaries.

The major culprit is the reliance on an overly optimistic investment rate assumption of 7.5%. Professional investors such as Warren Buffett of Berkshire Hathaway state that 6.5% is a more realistic rate of return, and even that rate may be optimistic.

If the investment rate assumption of 6.5% is used, LACERS’ unfunded liability based on market values will soar to almost $9 billion and the funding ratio will plummet to 61%. This is a far cry from the advertised $5.5 billion shortfall and a funded ratio of 72.6%.

The use of the more realistic investment rate assumption of 6.5% will also cause the Annual Required Contribution to increase by over $300 million, putting an even bigger dent in the City’s budget.

And this does not include the higher Annual Required Contribution for the Los Angeles Fire and Police Pension Plans that cover 26,000 active and retired firefighters and cops.

Together, the combined unfunded pension liability will soar to over $15 billion.

Despite this looming crisis, Mayor Eric Garcetti is unwilling to address real pension reform for fear of antagonizing the campaign financing leadership of the City’s public unions. Rather, he continues to support this shell game, this Ponzi scheme, burying his head in the sand, pretending there is no crisis, hoping beyond hope that the stock market will bail the City out, even though it will dump tens of billions of unfunded pension liabilities on the next two generations of Angelenos.

Rather than continuing down this path that will result in massive increases in our taxes, Mayor Garcetti needs to stop “waffling.” He should implement the recommendations of the LA 2020 Commission and the Neighborhood Council Budget Advocates to establish a “Commission for Retirement Security” to review the City's retirement obligations in order to promote an accurate understanding of the facts (transparency) and to develop concrete recommendations on how to achieve an equilibrium by 2020.

Without real pension reform, the next two generations of Angelenos will be short changed as escalating pension contributions will crowd out basic services while, at the same time, they will be paying more taxes to fund the past financial follies of the overly ambitious Eric Garcetti.

(Jack Humphreville writes LA Watchdog for CityWatch. He is the President of the DWP Advocacy Committee and is the Budget and DWP representative for the Greater Wilshire Neighborhood Council. He is a Neighborhood Council Budget Advocate. Jack is affiliated with Recycler Classifieds -- www.recycler.com. He can be reached at: [email protected].)

-cw

Explore

Our mission is to promote and facilitate civic engagement and neighborhood empowerment, and to hold area government and its politicians accountable.

CityWatch Los Angeles

Politics. Perspective. Participation.

CityWatch Los Angeles

Politics. Perspective. Participation.

25

Fri, Apr