CommentsCORRUPTION WATCH-Except for rare instances like Sodom and Gomorrah, there is life after the Fall.

Rome is still around. Life continued after Crash of 1929, and everyone did not die after the Crash of 2008. Thus, the fact that residential real estate prices in Los Angeles are turning soft should not alarm you, nor should it surprise you, as LA continues its descent to favela status.

After the Crash of 2008 and the subsequent Geithner-Obama economic tomfoolery, we ended up with an orange buffoon in the White House. No matter what one thinks of Trump, he is certainly a change. By now everyone should realize that Trump suffers from serious cognitive impairment. Even ex-Gov Chris Christie admitted it. Ironically, however, Trump’s Mercantilism from 1550 is better than the Geithner-Obama extreme Wall Streetism where literally trillions of U.S. dollars went to the 1%ers in the U.S. and secretly, trillions more went to the Davos Set in Europe, all while Main Street got raped.

Back Here on The Home Front

What can Angelenos do right now as LA slides downward? If your home’s price is hyper-inflated do not take out a second mortgages unless you are prepared to pocket the money and let your house sink into foreclosure. That is seldom a prudent strategy for a family’s longtime well-being.

When residential prices drop by 1/3 or more and your home is “under water,” do not worry as long as your income remains steady and you do not need to sell. In a weird way, the thousands of homeowners who will be financially trapped in their homes may make Los Angeles a more stable place with more cohesive neighborhoods and perhaps better schools as families stay involved with the same schools while their children age. The quality of schools is a function of the quality of the neighborhood. Homeowner stability generally increases the quality of life in all areas.

Month to Month Rent Rather than One Year Leases

When rents escalate fast, renters want long-term written leases to stabilize their rents, but in a market with falling rents, shorter month-to-month rentals are wiser. Changing apartments can result in considerable savings. As a result, renters will have more disposable cash and that will buoy the general economy. Landlords, on the other hand, will want long-term written leases with draconian measures for early vacancies. In a market with falling rents, the renter has the advantage.

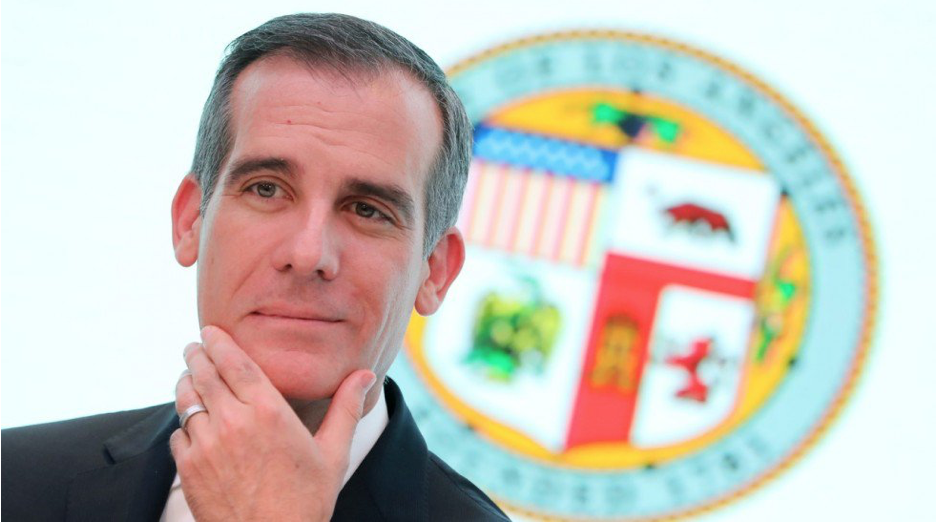

The City Will Go Bankrupt

Because the departure of Family Millennials will be a major cause of the crash/fall, employers will likewise have to move to places like Texas. With both the worker and the employer tax base smaller, the city will not have the revenue to pay off the absurdly high bonds running into the hundreds of billions of dollars. Wall Street saw where the Manhattanization Mania was leading and whether it did (or did not)want to finance these fools’ projects. That is why Garcetti had the $1.2 billion in Measure HHH bonds approved – so the city could give money to the developers who plan to go bankrupt. Since the city will have borrowed the cash for the mixed-use projects, Wall Street will not lose any money during the developers’ bankruptcies. After the city has forgiven its loans to the developers, the city, nonetheless, must repay Wall Street.

Do not think that these projects in Hollywood, infill and mega projects alike, will be generating future revenue. You are looking at future cash drains on the city treasury. This is the essence of Accounting Control Fraud – looting the city treasury like Ken Lay looted Enron. (Google William K. Black.)

Federalization of Los Angeles Debt

Since it would be politically untenable to bailout Wall Street again, this time the Wall Street bailout will be worded as “We can’t let the nation’s second largest city go bankrupt.” Of course, the hundreds of billions of federal dollars will be passed through mostly to Wall Street, which is populated with those who substitute mindlessly emotional memes for facts and logic. They will be deceived and all cluck, “Oh dearie, dearie me, we cannot let THE CITY go bankrupt.”

The Favelazation of LA

One likely scenario in the aftermath of the real estate crash will be the continued Favelazation of Los Angeles where much of the city becomes dirt poor and where only a few viable city services such as police, sewers, street or tree maintenance remain. As rents drop, landlords will let their buildings fall into disrepair. Idiots will seek criminal penalties against slumlords -- as if criminalizing an economic problem ever solved anything. Much of LA could replicate the South Bronx of the 1970s, but this probably will not start until 2025 to 2030.

Meanwhile, the Hills will use their wealth to wall themselves off from the Flats. With Virtual Presence hitting its stride within a decade, the wealthy living from Silver Lake to the Palisades will not have to descend to the Flats. Amazon will deliver food and whatever else is needed so that the fancy-schamcy plutocrats will not need to venture forth into the “Badlands.”

“What shall I do, where shall I go?”

The Family Millennials are going to Austin and many are returning to Tara where Atlanta’s housing costs are reasonable and job opportunities are good. LA’s future may be gone with the wind, but those who remain will give a damn. Who can tell what will occur? One thing is certain – a city run by a corrupt gaggle of thieves will not do well.

(Richard Lee Abrams is a Los Angeles attorney and a CityWatch contributor. He can be reached at: [email protected]. Abrams’ views are his own and do not necessarily reflect the views of CityWatch.) Edited for CityWatch by Linda Abrams.