CommentsCORRUPTION WATCH-Land Banking is a term that is new to Angelenos. The concept is simple: Wealthy people buy land rather than buy stocks or putting their money into a savings bank. They “bank” on the idea that the land value will rise faster than the stock market or interest on savings accounts. Land Banking was recently explained in a Canadian estate publication, Better Dwellings.

Land Banking Does Not Have to be Evil

Banking on the idea that the value of land will rise faster than Wall Street is a fine idea and is often true. As Better Dwellings explained, however, Land Banking can ruin a city. In fact, it can begin legitimately and then morph into multi-billion-dollar frauds. The process of corruption is the same with insurance (Equity Funding), with corporations (Enron), with investments (Bernie Madoff).

Bernie Madoff did not set out to construct a Ponzi Scheme. In the beginning, Bernie was successful in obtaining high rates of return for his investors. Then, one year the market did not perform as well as expected. Bernie’s ego, as the story goes, did not let him admit that his investing genius had not yielded high returns. In response, he falsified his success rate and paid out high dividends to keep up the fraud that his investors would always do well.

Bernie was confident that he would make enough money the next year to cover his losses. A couple times, he did recoup his those loses and got his accounts into the black. But his luck ran out and eventually, there was no way he could earn money to recover the prior years’ losses. Thus, Bernie used new investors’ money to pay off the older investors.

Belief is the Essence of Economic Fraud

Whether one is dealing with Bernie Madoff or Ken Lay at Enron or with Eric Garcetti in Los Angeles, the essence of all economic fraud is deceiving people. Supply and demand does not operate according to reality (until the crash hits), but rather, prices are fixed by what people believe the supply and demand to be.

LA has been subjected to false data about its need for housing for decades. On October 23, 1979, the LA Times ran a story about how real estate companies were pushing the bogus idea that LA had a housing shortage. (Housing Shortage: The Ultimate Myth, by John Betz.) The meme in 1979 was to conflate a shortage of housing for poor people, i.e. “affordable housing,” with a shortage of housing. That falsehood is alive today. One facet people do not understand is why there is the persistent need for the perpetual lies about a housing shortage.

Land Banking’s Liquidity Problem

Putting one’s money into a savings bank gives a person great liquidity. If I need my money, I can take it out. The money easily transfers from the bank into my hands.

Buying stocks does not have the same liquidity. While I can sell my stocks rapidly, the ups and downs of the market may deter me. If I bought my 100 shares of Hartford Insurance at $98/share and the price has dropped to $63/share, I am hesitant to sell – although I could legally sell and take the loss.

When money is in a Land Bank, e.g. a hunk of Wilshire Boulevard, it takes quite a while to sell it and there can be significant tax consequences to the sale. Money invested in land is not liquid.

Accounting Control Fraud as a Hedge Against Lack of Liquidity

Here’s what the above convoluted heading means: Because stocks and land are not as liquid as cash in the bank, people have devised ways to goose the value of stocks and land investments. Enron used what is called Accounting Control Fraud to boost the value of the stock and the income of its officers. In brief, they lied to everyone including the government and they got their accountants at Arthur Anderson to likewise lie, hyping profits and concealing losses. Yes, a House of Cards can unexpectedly crash.

The Enron officers were criminally charged and Arthur Anderson went out of business. Did this deter Accounting Control Fraud in land deals? Of course not. Arresting Willie Sutton did not stop bank robberies and sending Capone to prison did not stop the Mafia or income tax cheating. Nor, did those prior arrests deter the trillion-dollar Wall Street mortgage frauds which crashed the economy in 2008.

The fear of criminal penalties, however, is a deterrent to fraud. That was reflected in the repeal of Glass Steagall in 1999 and the legalizing of Credit Default Swaps. When commercial banks and investments houses cannot be owned by the same entity and when a company may not issue Credit Defaults Swaps, the government has fashioned rules that make certain criminal frauds inoperable. At one time, no one would buy a Credit Default Swap since they could not be legally enforced.

Thus, the legal structure a government establishes can alter the nature of the economic system from a bone fide economic system into one of Corruptionism. President Obama’s doctrine of “Too Important to Prosecute” when it comes to the Wall Street criminals, has made America safe for Corruptionism. That lesson has not been lost on the Los Angeles judicial system.

LA City Council Operates like a Reincarnation of Enron

Back in April 1979, the LA City Council passed its Rent Control Ordinance (Rental Stabilization Ordinance number 152,120), acknowledging that the wisest solution to the “affordable housing” shortage was to protect low income housing from undue rent increases and from demolition. Since 2001, the year that Eric Garcetti was first elected to the LA City Council for council district #13 in Hollywood, the City has destroyed over 22,000 rent-controlled units, followed by the bogus claim that we lack affordable housing because we are not constructing enough new apartments. The shortage of housing for poor people was manufactured by the City’s housing policies.

The Wonders of Fraud

One huge advantage of fraud is that the crook gets to invent the facts to ensure that unsuspecting investors will part with their money. With Bernie, the fraud was that his investment wisdom was generating about 14% per year. With Enron, the fraud was that they were making tons in profits with no losses.

In Los Angeles, Land Banking arises from the falsehood that there is a huge demand for new housing, especially in Transit Oriented Districts. That falsehood translates into the claim that the city needs to give billions of dollars to real estate developers. In 1979, the real estate industry was pushing the bogus claim, but after 2001, the City itself became the generator of Lies and Myths.

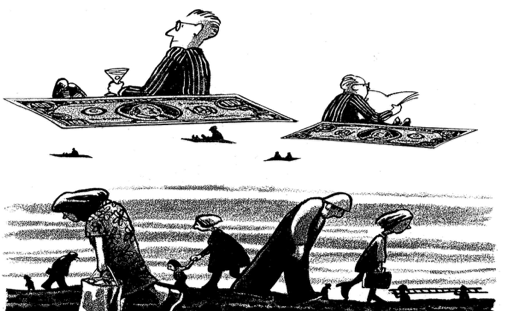

The Toxic Mixture of Ambitious Politicos with Greedy Land Bankers

While one has no control over the rate of interest his savings bank will pay him, wealthy people who deposit their millions of dollars into the Land Bank of Hollywood, for example, have a great degree of control. Lies and myths about an alleged population increase and the need for more housing misshape people’s perception of what is a proper price for a house or rent for an apartment. When the falsified data comes from the City itself, almost everyone is deceived.

The City Was Caught Red Handed

In January 2014, Judge Allan Goodman caught the city with its pants on fire with Garcetti’s update to the Hollywood Community Plan [HCP]. Garcetti’s HCP falsely claimed that between 2000 and 2005, Hollywood’s population had zoomed upwards from about 210,000 to about 224,000 and he cited the Southern California Association of Governments [SCAG] as the source of figures on that population surge. In reality, SCAG’s official 2005 population stat was only 200,000 -- 24,000 less than Garcetti’s representation. Judge Goodman found that in 2011, Garcetti’s HCP had plenty of time to report accurate population data prior to the City Council’s June 19, 2012 unanimous approval of Garcetti’s plan.

The purpose behind the fraudulent population numbers was obvious. Since Hollywood had been losing population since 1990, there was no rational basis to claim there was a housing shortage. If the population had been decreasing there would be no reason to construct thousands more units in Hollywood. However, billionaires had invested hundreds of millions of dollars into the Hollywood Land Bank.

By 2010, Hollywood’s population had fallen to 198,228. Judge Goodman ruled that Garcetti’s HCP intentionally used fatally flawed data and wishful thinking to the extent that it subverted the law.

Why Didn’t the Discovery of the Massive Fraud Sink the Ship?

If a tree falls in the forest where no one hears it, does it make a sound? Is criminal behavior that law enforcement ignores and the courts sanction criminal behavior?

The Lynchpin of the Criminal Behavior – the Vote Trading System

As previously reported ad nauseum, Penal Code § 86 criminalizes LA City Council’s Vote Trading System by making it illegal to vote Yes on an item in return for another councilmember’s yes vote. Buying a vote with cash is bribery and buying a vote with a return vote is bribery. Also, the system violates the Brown Act which requires all decisions on a matter before the city council be based on public discussion. When the vote is based on a secret vote trading agreement and divorced from public discussion, the council has violated the Brown Act.

The criminal vote trading system gives the developers control over the rate of return on their Land Banking deals. They can buy rent-controlled units, illegally force people to move out, and then construct high rise luxury apartments. All they need is for a councilmember to place his project on the city council agenda and it gets unanimous approval.

This vote trading system is criminal, but it is the glue that holds LA together. Judge Goodman’s January 2014 ruling that the City uses Lies and Myths must have been a gigantic shock. The Hollywood Community Plan was not about a single project – it applied all of Hollywood, which Garcetti had earmarked for Manhattanization.

How Can the City Continue to Push Through These Absurd Projects?

City Hall and the developers found their white knight in the form of Judge Richard Fruin who ruled in December 2016 that the City is above the law. According to Judge Fruin, the City may continue to engage in felonious vote bribery because its actions are “non-justiciable” – beyond the power of the courts to control.

As previously explained, because the city vote trading system guarantees that every project will receive unanimous approval, all residential real estate becomes priced at its high development value and not at its lower living space value. Thus, the vote trading agreement was crucial to keeping the housing Ponzi Scam alive – thank you, Judge Fruin. Newer buyers are forced to pay more money into the housing market so that those who entered the scam earlier get paid off. Judge Fruin claims that he is very smart, so he must understand the Ponzi aspects of the vote trading system.

Will a Day Reckoning Arrive?

Without the Crash of 2008, Bernie Madoff’s Pozni Scheme may have gone undetected. The crash, however, caused so many of his investors to withdraw all their funds rather than passively collect their 14%, that Bernie’s stash of billions upon billions of dollars was depleted. Similarly, some event like a meteor from outer space can hit LA and not even Judge Fruin will be able to protect the criminal enterprise. The Trump tax bill may be that meteor.

When homeowners cannot deduct the interest payments on mortgages in excess of $500,000, that can be a disaster. When that provision is combined with not allowing California state taxes to be deducted from federal income taxes, the high end of home buying public is hit twice.

According to Zillow, “The median home value in Los Angeles is $633,400. Los Angeles home values have gone up 7.1% over the past year and Zillow predicts they will rise 1.7% within the next year.” That means more than 50% of new home buyers will not be able to deduct all their interest payments. Look at the family who purchased a 2,027-sq. ft. home north of Franklin for $1.5 million in September 2017 and are carrying a mortgage of about $1.1milion. That means the interest on $600,000 will not be deductible. People who can afford $1.5 million in September 2017 are also paying significant state taxes – which may no longer be deductible.

Will buyers and renters come to their senses and realize that their belief in the market price of housing in Los Angeles has not been based on Supply and Demand but rather on court-sanctioned real estate fraud? You can lead a buyer to your listing, but you cannot make him buy.

(Richard Lee Abrams is a Los Angeles attorney and a CityWatch contributor. He can be reached at: [email protected]. Abrams views are his own and do not necessarily reflect the views of CityWatch.) Edited for CityWatch by Linda Abrams.