CommentsPERSPECTIVE--Mayor Eric Garcetti caught some flak in a recent LA Times article for failing to mention the $1.1B the city must pay to fund employee pensions.

But let’s be fair: the Chair of the Budget and Finance Committee deserves an equal share of the criticism:

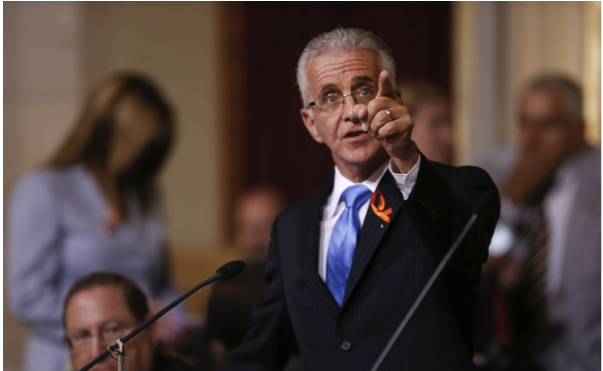

“Despite recent funding shortfalls, over long periods the performance of the pension system’s investments has met or surpassed expectations.” Council Member Paul Krekorian (photo above), as quoted in the LA Times, November 18, 2016.

This is an example of the naiveté of our elected officials. Mr. Krekorian forgets, or chooses to ignore, that past performance is no indication of future returns; the further back in time, the less relevant are the results. The 15-year return for LACERS is 6.5%; the 10-year is 5.9%. The world economy has undergone major structural changes over the 30 year period, for which the average return was 8.4%. Projecting investment performance based on data from over 20 years ago is as useful as comparing Barry Bonds’ stats to Hank Aaron’s.

Or maybe it’s an acknowledgement that city officials do not represent the public as a whole, only the city employees and retirees, many of whom reside outside of the city. According to the results of a 2014 study reported by the Times, about two-thirds of city employees live elsewhere. So much for a multiplier effect. While those employees cannot vote in city elections, the unions representing them are powerful political forces.

The mayor and City Council hope to make a dent in the problem by taxing short-term, Airbnb style rentals, effectively trashing zoning in residential neighborhoods. Certainly, a share of the new gas tax will flow to the city, along with some “legalized” pot-related revenue (it remains to be seen how the Justice Department deals with the conflict between federal and state laws). However, the city could lose some, or all, of the surplus transfer from the DWP.

The fact remains, 20% of the general fund goes to cover the city’s pension contribution, a rate that has increased from 5% in 2002. It’s been fairly flat at around 20% for a couple of years. In 2012 it was 15%, the same for 2008, during the height of the subprime mortgage meltdown. Overall, city revenue has increased by $1.2B since Garcetti took office. With that much of an increase, one would expect the city’s contribution rate to drop. It’s an inconsistency any CEO would have to explain to a board in the form of a simple variance analysis.

It is the result of the deteriorating pension position. While explaining what an unfunded liability means would put any general audience to sleep, it is far easier – and more understandable – to present an analysis of the contribution rate over a period of several years. It would make the growing unsustainability of pension promises apparent in terms the public could appreciate.

I will propose to the Government Accounting Standards Board (GASB) to make such information a required disclosure in the Comprehensive Annual Financial Report (CAFR).

Who knows – maybe Paul Krekorian would be enlightened.

(Paul Hatfield is a CPA and serves as President of the Valley Village Homeowners Association. He blogs at Village to Village and contributes to CityWatch. The views presented are those of Mr. Hatfield and his alone and do not represent the opinions of Valley Village Homeowners Association or CityWatch. He can be reached at: [email protected].)

-cw

Sidebar

Our mission is to promote and facilitate civic engagement and neighborhood empowerment, and to hold area government and its politicians accountable.

CityWatch Los Angeles

Politics. Perspective. Participation.

CityWatch Los Angeles

Politics. Perspective. Participation.

15

Sun, Feb