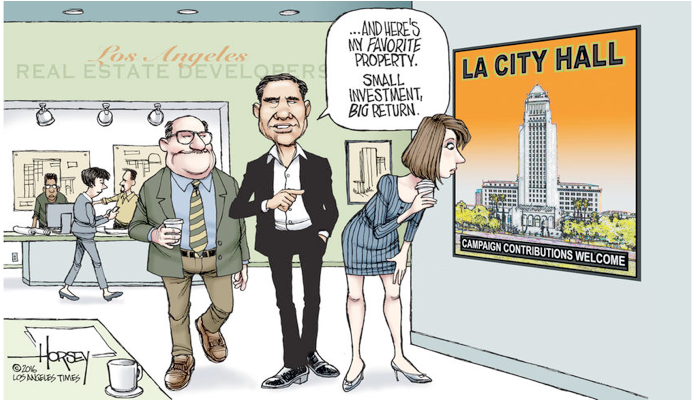

CommentsCORRUPTION WATCH-The reason Los Angeles housing prices are outrageously high will never published by the LA Weekly, the LA Times or any other news outlet. You can be sure you will never hear it from KNBC’s Channel 4's Conan Nolan, Garcetti’s sycophant extraordinaire. Los Angeles residential real estate does not sell for its value as Living Space but rather for the hyped-up value as a Speculative Investment. The result is that Los Angeles homeowners pay a huge Corruption Tax.

In 2006, Gail Goldberg, then LA’s Director of Planning, warned Eric Garcetti against allowing developers to buy the zoning they wanted rather than allowing the law to set the rules. Eric Garcetti completely ignored Director Goldberg.

A developer knows he can buy five R-1 homes and then “bribe” for then to be up-zoned to multi-family, allowing him to build 30 to 60 apartments. Sure, he may have to pay an additional $10,000 to $25,000 to Mayor Garcetti’s Fund and kick down some more favors to the councilmember, but in Los Angeles, the developer, and not the law, sets the zoning for land.

The Need for Families to Park Their Wealth

If you’re a Family Millennial, you are looking for somewhere to “park” your wealth. Part of everyone’s income needs to be set aside and not consumed for day to day expenses. The question is, where to park one’s income?

The Pros of Cons of Traditional Places to Park Your Wealth

Bank accounts do not pay enough interest to make them a good place to park savings long-term. Stocks do well, but in a market rigged for the high-end traders, it’s a serious risk. In the Crash of 2008, some once “ultra-safe” stocks like Hartford Insurance lost over 90% of their value. Whole life insurance can be a very safe place to park cash, provided you deal with an insurance company that is admitted to do business in New York State. If one does not prematurely die, Whole Life Insurance will have accumulated considerable cash value by retirement time and that can become a safeguard in old age. Millions of Americans, however, park most their money in their homes.

Traditionally, home values tend to increase over time, at least enough to keep up with inflation. The mortgages are usually paid off before retirement, which means seniors can live “rent free” except for property taxes and special assessments. In 1950, the average age to get married was 22.8 years old for men and 20.3 for women. By the year 2000, those ages had increased to 26.8 for males and 25.1 for females. After the Crash of 2008, the age at which the young started families increased to 29 for males and 27 for females (2013 data.) These figures are important because they show that people are starting families and their economic planning about seven years later than the Baby Boomers did. That leaves them less time to accumulate income for old age.

While typical Baby Boomers will have paid off their 30-year mortgages when they are in their early fifties, most of today’s Millennials will be in their late 50s or early 60s when they finish their mortgage payments.

When Baby Boomers, many of whom are about to retire, originally put into their homes, it was based on the homes’ value as Living Space. Now, in areas like Los Angeles, the prices of new homes are no longer based on Living Space value but on the Speculative Value to a developer. This is one facet of the disaster which Gail Goldberg foresaw. When developers can just purchase the zoning they want, they know that buying in an R-1 or R-2 area is cheaper than buying into areas which already have been up-zoned. Thus, it makes sense to buy-up detached homes. Their payments to the Mayor’s Fund and to the councilmembers will achieve whatever up-zoning the developer needs.

In a City not based on corruption, developers would know that zoning sets the property’s use; they would not even try to buy R-1 properties. Had Garcetti heeded Gail Goldberg, today’s families could afford to purchase homes based on their value as Living Space.

Los Angeles’ Millennial Family has to compete against developers who will bid up the price of a detached home based on its Speculative Value. Even if the family could outbid a developer today, it has to realize that tomorrow another developer can come along and buy up five or ten nearby homes and, after contributing to Garcetti’s Mayor Fund, be able to have the land up-zoned for a four-story condo project overlooking that family’s backyard.

Residences Purchased on their Speculative Value Result in a Crash

As more Family Millennials re-locate away from Los Angeles, reality begins to sneak into the housing market. There are fewer people to rent these new apartments or buy those new condos in the sky.

The birth rate of the Millennials peaked twenty-five years ago. Thus, each year there will be fewer young Millennials moving into dense urban areas. While Los Angeles’ birth rate is currently high enough to out-pace deaths and the flight of the Family Millennials, LA’s birth rate is still dropping. (This is inevitable since the Family Millennials leaving are in the child-bearing age range.)

Why Economists Fear “Corruptionism”

There are two types of inflation: There is the normal slow upwards creep of the Consumer Price Index (CPI). Since it is slow, people can adjust to a creeping rise in consumer prices and employers can afford to pay their employees a little more so that, over all, the system remains in equilibrium.

But Los Angeles experiences another type of inflation in the form “corruptionism” which introduces hyper-inflation into the housing market. As we have pointed out, a combination of destroying the homes of poor people and the re-valuation of residential properties for their Speculative Value have resulted in a huge increase in the cost of LA housing – an increase which reflects no increase in actual value. The housing market is based on Speculation, so rents increase in response to price increases based on that Speculation. But employers cannot afford to pay higher wages just because their employees are over paying for mortgages and rents. When housing costs jump 7% in one year, no employer can increase all his employees’ salaries by 7%.

The increase of housing costs does not reflect an increase in the actual value of these properties as living spaces. A three-bedroom craftsman built in 1920 is not worth any more as Living Space today than it was in 1920, 1960 or 1970. Yet, when one looks at the current mortgages, one sees a monthly mortgage of about $4,000/month on a $900,000 home. Adjusted for inflation, the monthly mortgage in 2017 based on Living Space should be less than $2,000.

Angeleno Homeowners and Renters Pay a Monthly Corruption Tax

That means the homeowner or renter is paying over $2,000/month as a “corruption tax.” That is the amount an LA family has to pay to the bank over and above the increase of the CPI. That extra mortgage money paid each month represents no additional value to the property.

Suppose all the money the homeowner paid in LA Corruption Tax had been invested in the stock market. Let’s be very conservative and assume that the corruption tax is only $10,000 per year. If that money had been invested in 2009, it would show a rate return of 14.315% (not adjusted for CPI inflation.) In other words, a $10,000 stock market investment in 2009 has become $14,315. In ten years, the homeowner would have an extra $140,000!

We can all figure out our own Corruption Tax rate and how much money we would have if we had been able to invest that money in the stock market.

Of course, we will all face the financial nightmare when corruption in the housing market again brings down the rest of the economy. That is likely to wipe out stock portfolios as well. The irony is that the closer we get to a crash, the more we should park money in insured federal bank deposits. Unlike equity in a home or stocks, those dollars do not disappear in a crash. In other words, an increase in insured savings is a hedge against the next crash.

As Keynes knew, liquidity of capital is important to the individual. When the crash starts, you cannot get cash from your non-liquid assets fast enough to save yourself. Thus, money in government insured bank deposits can save a middle class family. But first, that family cannot have parked all its wealth in its home. The only way to avoid that financial trap is to buy a home in states like Texas or Utah or Georgia or Colorado. That way a family does not pay the LA Corruption Tax and has enough money to diversity its investments.

(Richard Lee Abrams is a Los Angeles attorney. He can be reached at: [email protected]. Abrams views are his own and do not necessarily reflect the views of CityWatch.) Cartoon: LA Times. Edited for CityWatch by Linda Abrams.

Explore

Our mission is to promote and facilitate civic engagement and neighborhood empowerment, and to hold area government and its politicians accountable.

CityWatch Los Angeles

Politics. Perspective. Participation.

CityWatch Los Angeles

Politics. Perspective. Participation.

27

Sun, Apr