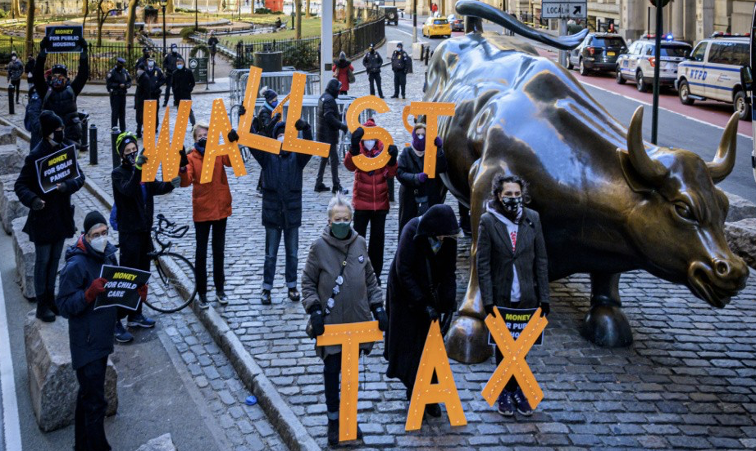

CommentsCOMMON DREAMS-Participants in the photo above are holding letters spelling TAX WALL STREET.

In the face of worsening pandemic conditions in the country, a coalition of Activists gathered outside the New York Stock Exchange at Wall Street to call for the Equitable Taxation of Corporations, demanding legislators to pass the Financial Transaction Tax to generate around 9 billion dollars needed for Covid-19 Recovery and Essential Services.

An insidious side of American capitalism has been highlighted by the pandemic. Millions of wealthy Americans have made passive stock market gains while millions of income-dependent Americans have lost their jobs and their livelihoods, and disproportionately their lives.

If ever there was a time to correct a broken system, it's now. While the richest 25 million Americans were increasing their wealth by an average of over $200,000 in 2020, an equal number of Americans were struggling to provide ENOUGH FOOD for themselves and their children.

How Does Stock Growth Cheat the Poor?

Low-income people are given very little opportunity to share in the economic growth resulting from 75 years of American productivity. People who have money can buy stocks, wait for a while, and ultimately get richer by doing nothing. But low-income Americans have to depend on wages for their fair share of national economic growth -- and wages have barely budged in over 50 years!

One could argue that stock market investors are taking a big risk with their money. But people with money can afford to wait out market slumps, which normally don't last very long. The average annual S&P 500 return over the past sixty years is about 8 percent. It's almost a sure thing for a cautious and patient investor.

This unending stock market growth represents long-term American prosperity. In a year of disease and death and destroyed families, should a massive, inexplicable increase in new American wealth be directed to the rich end of society simply because they had the money to buy more stocks? "Pandemics should be the great equalizer," says political analyst Fareed Zakaria. But instead "the virus is ushering in the greatest rise in economic inequality in decades, both globally and in the United States."

Everyone deserves a share of stock market growth, especially from the technology sector. The U.S. taxpayer paid for 75 years of government research to develop all the technology that a few well-positioned corporations eventually appropriated as their own. In February 2020, the market capitalization for Big Tech (Apple, Microsoft, Amazon, Google, Facebook) was about $5 trillion.

By February 2021, it was nearly $8 trillion. A sixty-percent increase in a year! No one has profited more from the decades of taxpayer input than these massive technology companies. But technological growth is a society-wide success story. As explained by Mariana Mazzucato: "From the Internet that allows you to surf the Web, to GPS that lets you use Google Maps, to touchscreen display and even the SIRI voice activated system -- all of these things were funded by Uncle Sam."

"The Dow soars, wages don't," says Alexandria Ocasio-Cortez. "Inequality in a nutshell.

How Could We Make It Fair?

(1) A Financial Transaction Tax (FTT) makes sense for a number of reasons:

- Revenue: An FTT has the potential to generate an estimated $80 billion to $300 billion in revenue every year

- Precedent: Four of the top six countries on the Heritage Foundation's Index of Economic Freedom are Singapore, Hong Kong, Ireland, and Switzerland, all of whom have financial transaction taxes.

- Fairness: Securities traders pay no sales tax, and their SEC fee amounts to just $22 on every million dollar purchase. That's two cents on every thousand dollars. And even that goes to the financial people, not to the public.

(2) A Wealth Tax (or "Wealth Giveback") is just as sensible:

Just a 2% percent tax on total financial wealth would generate enough revenue to provide nearly a $14,000 annual Guaranteed Income to every American household (including those of the richest families).

As already noted, over the past sixty years the S&P 500 has been growing at an annual rate of about 8 percent. Millionaires won't be hurt too much by a two-percent wealth tax on their financial assets. But at the other end of inequality, that two-percent tax on a Total Market valuation of $40 trillion would generate $800 billion -- enough for $20/hour full-time jobs for 20 million Americans.

It wouldn't be difficult to implement. Stock ownership is carefully recorded and eminently trackable, to the point that a two-percent deduction is possible without unwieldy administrative costs.

Of course, there will be the usual backlash from self-serving investment groups. The Tax Foundation spews a litany of excuses: "A financial transaction tax [would result in] lower liquidity, potentially increased volatility, and lower price of assets...increased volatility can increase risks." And with typical bluster the Wall Street Journal laments that "A tax on securities trades would. . .create large economic and societal distortions." Perhaps the Journal has failed to notice the last 35 years of society-distorting inequality.

The Year of Runaway Redistribution to the Rich

Nearly half of Americans own no stock at all. Another quarter of the population have 401(k) retirement funds under $23,000. With bank account interest hovering around zero percent and at least a third of American families with nothing to invest, there's little chance that the poorest among us could participate in the passive get-rich savings plan of stock ownership.

At the other end the numbers get more and more outrageous. In November of 2019 the Wilshire Total Market stood at about $32 trillion. After plunging at the start of the pandemic, by February of 2021 it had risen to $41 trillion. That's a $9 trillion overall increase for stockholders. Since the richest 10% of Americans own 84 percent of all stocks, that's over $300,000 apiece in a little over a year.

$300,000 in stock gains for each of the richest 25 million Americans, while an equal number of Americans can't properly feed their families. The poorest among us are being cheated. They're being cheated out of the opportunity to share in the great prosperity to which they and their parents and grandparents all contributed.

(Paul Buchheit is an advocate for social and economic justice, and the author of numerous papers on economic inequality and cognitive science. He was recently named one of 300 Living Peace and Justice Leaders and Models. He is the author of "American Wars: Illusions and Realities" (2008) and "Disposable Americans: Extreme Capitalism and the Case for a Guaranteed Income" (2017). This piece appeared on CommonDreams.) Photo: Erik McGregor/LightRocket via Getty Images. Prepped for CityWatch by Linda Abrams.