Alert! City Hall Raiding Reserve Funds … in Boom Times

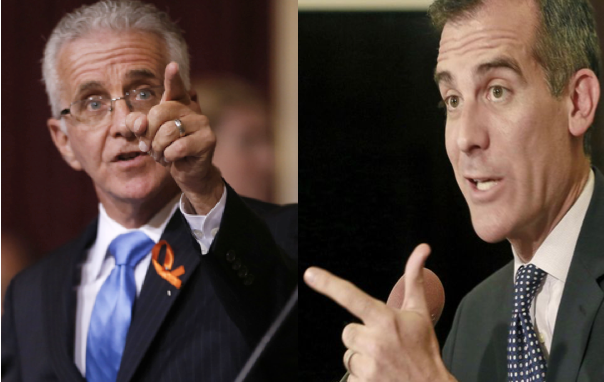

LA WATCHDOG--Mayor Eric Garcetti and Councilman Paul Krekorian, the chairman of the Budget and Finance Committee, have touted the strength of the City’s Reserve Fund and its Budget Stabilization Fund as an example of their prudent management of the City’s finances.