CommentsCOVID 19 POLITICS-As the U.S. begins to reopen after being shut down to protect us from spreading Covid-19, many people are beginning to talk about a choice between what is good for the economy and what will keep us healthy.

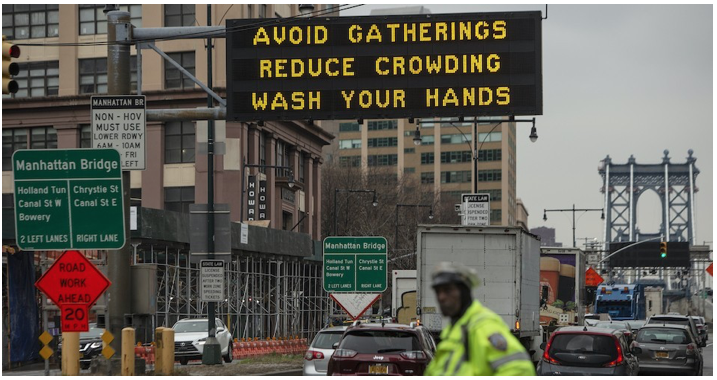

Much pain and suffering has come as people have lost their livelihoods and their homes, and so we need to move quickly to put into place the things that will ensure that people have what they need to live. But rather than sacrificing people for the economy, we need to rethink what we mean by "the economy." No one needs to be killed for us to have a healthy economy. (Photo above: A sign warns residents to take steps to contol the coronavirus outbreak at the entrance to the Manhattan Bridge in Brooklyn on March 19, 2020 in New York City. (Victor J. Blue/Getty Images)

We live in a world where there is enough of everything we need for us all to live well, and to do so within the ecological limits of the planet. And yet, as the Covid-19 crisis has laid bare, the social systems we live in lead to grotesque wealth for some, extreme devastation for many, dangerous underinvestment in the public infrastructure we need to be safe, and political systems controlled by those who profit from destruction of our environment and shared social fabric.

As we work to keep people safe from Covid-19, while protecting their livelihoods, we can shift our economies to build a world where we all have enough. If we keep ourselves focused on tackling our inequality crisis, even as we build toward environmental sustainability, we can develop an economic system that meets our human needs, without anyone needing to die for it.

Economic policies to get people living well

There are many things that governments can do to make sure that people have what they need. As I write this, there is a proposal in the California legislature to allow people ten years to pay the rent they cannot afford to pay now. Several European governments gave money to companies in the Covid-19 crisis on the condition that they use the money to keep people on payrolls. We can give everyone a universal basic income (UBI) and health care. There are many policies that can be enacted right now that will protect people's livelihoods in the short term and which will build a better future for us all.

In order to pay for those programs and help the country get back on its feet, we need to tax the wealthy and invest in our common good. We need steep increases in wealth taxes, progressive property taxes, and progressive income taxes. We need to take the profit motive out of basic housing and healthcare. We need to invest in public education. We need to make sure that there are processes in place to ensure that everyone has access to the things they need to live a decent life. Some of these are things that the US did with great success at the beginning of the twentieth century.

In Capitalism and Ideology, Thomas Piketty argues that after WWI and WWII, as people in the U.S. and Europe emerged from devastated economies, and where people had sacrificed a lot for the common good, there was a powerful public support for challenging the forms of inequality that had existed in the prior period. In Britain, the levels of taxation imposed on the wealthy were so huge that they led to a virtual end to the aristocracy. In the same period, the US developed deeply progressive income, wealth, and inheritance taxes.

After World War I, many industrial assets were taken over by the U.S. government and run for the public good. In America Beyond Capitalism Gar Alperovitz offers evidence to show that many of those nationalized industries have been more efficient, and effective at providing for social goods, than private businesses. Mike Davis has argued that we need to nationalize some of the basic industries and companies we depend on. He argues for a nationalization of Amazon and of wifi service.

If those sounds like things we shouldn't do because they are "bad for the economy," it is important to note that, as Piketty documents, the years of decreasing inequality in many countries of the world, roughly 1950-1980, were years of increased economic growth in those same countries. Since that time, our economy in the U.S. has gone from one based on progressive taxation, to one where the wealthy actually pay less in taxes than the rest of us. In a New York Times op-ed David Leonhardt writes, "The overall tax rate on the richest 400 households [in 2018] was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income. This overall rate was 70 percent in 1950 and 47 percent in 1980." Because of that lack of progressive taxation, Jeff Bezos is about to become the world's first trillionaire. Just getting back to where we were in terms of taxation in 1950 would generate much of the income needed to provide for everyone's needs to be met. Very few people know that history, or the success, of those early twentieth century approaches to taxation and nationalization. As long as we have systems of accountability in place, we can make our economies more democratic without that leading to tyranny, corruption, a lack of innovation, or inefficiency.

So why does that all seem so impossible right now? Much of it has to do with a deep shift in how we think about how wealth is generated and what is good for the economy. That shift in beliefs was the result of a few different forces. In the 1980s Ronald Reagan and Margaret Thatcher were the public faces of a concerted political and intellectual assault on the idea that taxes and investment in our shared social fabric were paths to prosperity for all. They helped propagate the belief that those things lead to tyranny. Their work has been followed by decades of deep pocket investment by the Koch brothers, and others, in the intellectual work of very effective right wing think tanks.

Another factor are the very real failures in the experiments in nationalization led by the countries that ended up with authoritarian communism. We now know that it is not a good idea for governments to have too much power over our economic decisions when those governments are not accountable to their people. The failure of those experiments casts a long shadow over our imaginations, and there are many lessons we need to learn from those failures. And yet, our experience in the US in the mid twentieth century, and the experiences of many countries, has shown that nationalization under conditions of accountability, as well as deeply progressive taxes, actually make an economy work better.

"The Economy"

The third reason these ideas of progressive taxation, nationalization, and investment in public goods, seem so hard to imagine right now, is related to how we understand what is good for an economy. As we hear horrific statements from people in power about how we need to allow some people to die in order to save "the economy," it is worth pausing and asking what that precious beast "the economy" is, which is more valuable than human lives.

There is a view of what an economy is, and what is healthy for it, that is shared by the mainstream media, by liberal politicians, by right wing economists in Koch funded think tanks, such as the American Enterprise Institute and the Heritage Foundation, as well as by mainstream economists. It is the view that is taught in almost every economics department in the country. That view defines the economy as the set of things bought and sold for money. It assumes that the more things we buy and sell the better off "the economy" is. It assumes that the more markets are allowed to make social decisions the better off we all are. It assumes that more growth, measured in GDP, is good for "the economy." And many people who accept these assumptions also argue that inequality doesn't really matter because doing things that lead to growth will increase the size of the pie, so we don't need to worry about how that pie is divided.

While supporters of mainstream economics often say they are in favor of "free markets" and against government intervention in the economy, the notion of "the economy" they propagate, requires governments to protect ownership of land, contracts, and intellectual property. Some of those same people advocate for subsidies to the fossil fuel industry and huge investments in the military. They tend to argue that the economy is hurt when governments do things to make it less monopolistic, or force it to serve more than a small number of people. They argue against rent control because it distorts markets, but they don't argue against bailouts for banks. Far from wanting markets to be free from government interference, proponents of mainstream approaches to economics generally argue for as much freedom for capital as possible.

Increased freedom for capital means that capital is allowed to shop the globe to find places to hide from taxation. And freedom of capital has led to a huge expansion of the size and power of the finance sector. Only 15% of money invested by large banks today is invested in actual production. The changes that have come from allowing more freedom for capital have led to extreme increases in inequality all around the world, even as they have actually undermined economic growth.

As people in the U.S. government talk about the need to sacrifice human lives for the economy, it is good to remember that "the economy" is not what we care about. We care about how we are all doing. What is good for a company's stockholders and owners is not always the same as what is good for employees. While it might be good for economic growth to have the Tesla factory in Fremont California open up without a safety plan, that would not be good for the workers. And there are other ways to make sure the workers in that factory have enough to pay their rent and buy food. We could tax Musk's wealth and provide a safety net for the workers.

When he defied the shut down and opened the factory in defiance of the county health officials, Elon Musk claimed to want to be free from the tyranny of the government. And yet his businesses have received $5 billion in government subsidies. Wealth and productivity are the results of many complex social processes, including subsidies. The wealth generated by factories, such as Tesla, are not mostly, or even primarily, the results of the actions of the owners and stockholders. The success of businesses is always part of a complex social process. As Piketty writes, "all wealth creation depends on the social division of labor and on the intellectual capital accumulated over the entire course of human history, which no living person can be said to own or claim as his or her own personal accomplishment." To develop health and resilience in the material world we depend on, we need to use the resources that belong to society to do the things needed so that we can all live well within the ecological limits of the planet.

Alternative economic approaches

There are many economic theorists, working outside the mainstream paradigm, who question its most fundamental assumptions. Some of the best of these are Ha-Joon Chang, Clair Brown, Kate Raworth, and Amartya Sen. In Latin America an alternative is developing based on the idea of buen vivir, living well in our relations with each other and with the rest of nature. We need to think of the economy as the material substrate of our common lives, rather than as a self-contained thing which has its own needs. From that perspective, the things we need to do to improve our economic well-being are vastly different ways from what mainstream economists are arguing we need to do as we come out of the shutdown. We don't need to open factories while they are unsafe. We don't need to bail out the cruise ship industry or the fossil fuel industry. Instead we need to make sure that there are systems in place to protect people's livelihoods.

Those alternative economists argue that we shouldn't measure the success of an economy based on how much is bought and sold, but rather on how much it is meeting our needs The most commonly used measure of the health of an economy in the world right now is GDP, which, roughly, measures how much is bought and sold. The Genuine Progress Indicator (GPI) and the Human Development Index (HDI) do a much better job at measuring the ways an economy serves our human and ecological needs. And they argue that markets are not the best ways to decide where social resources should go. For example, the labor market does not need to be the main way we decide who has money and who doesn't. Giving everyone a universal basic income (UBI) increases well-being and stimulates economic activity without relying on a market in labor.

Conclusion

Lurking behind the Covid-19 crisis, are the inequality and climate crises. Dealing with them was urgent before Covid-19 hit us, and the actions we take in the next 6 months will have huge implications for the world we create as we come out of it. There is plenty of money and wealth in our society to meet all of our needs while staying within the ecological limits of the planet. There is a fairly clear and well proven path to building that economy. The hard part is developing the political will to get us there. Part of building that political will is shifting how we understand what is good for the economy. Rather than being driven to do what is good for capital, we need to focus on doing the things that will help us share our social wealth and use it to solve the crises we face and to build a resilient, just, sustainable common future. The economy exists to serve our needs, it isn't a god which requires sacrificial victims.

(Cynthia Kaufman is the author of Challenging Power: Democracy and Accountability in a Fractured World, Getting Past Capitalism: History, Vision, Hope and Ideas for Action: Relevant Theory for Radical Change. She is the director of the Vasconcellos Institute for Democracy in Action at De Anza College. She blogs at cynthiakaufman.wordpress.com. This perspective posted earlier at CommonDreams.org.)

-cw